The US consumer is the bedrock of our economy.

If that’s truly the case — (and it is) — then signals are flashing everywhere that the economy is headed for trouble.

Case in point…

The Tylers over at ZeroHedge reported:

Bloomberg Intelligence’s Joel Levington published a new report Monday, citing new data from CarEdge that showed a staggering 39% of vehicles financed since 2022 carry negative equity, including 46% of EVs…

What this basically means is that balances on people’s auto loans are more than the value of the vehicle they’re paying on.

Now falling car values shouldn’t come as a surprise to anyone.

A car is not an asset in any “investment” sense of the word. It’s a means of transportation.

In the world of business, vehicles are recognized as “depreciating assets” (over the “useful life” of the vehicle) on a business’ taxes. They have a tax-reducing effect on their bottom line.

Depreciation refers to the decrease in value of long-term assets over time. Depreciation is spread over the useful life of the asset and is intended to realistically reflect the actual value of the asset and the profit. Furthermore, it is designed to have a tax-reducing effect. Depreciation of vehicles is done on a linear basis, meaning the vehicle’s value is evenly spread over its useful life. The vehicle’s useful life plays a crucial role in this process. The amount of depreciation depends on the purchase price and the vehicle’s useful life.

There’s a maxim that says cars depreciate by over 10% the minute you drive it off the dealer’s lot. So you’re pretty much starting in the hole.

So, again, the fact that the value of American’s cars are falling shouldn’t be any surprise. What is troubling is the fact that consumers still owe so much on their vehicles.

Consumers Are Sinking Fast

The Federal Reserve just reported that the average finance charge for a new car in Q3 2024 was 8.76%! But that’s not the really shocking part. What really catches your attention is that’s the rate being charged for a 72 month loan!

Six years to pay off a car? Not long ago four years was pretty much the financing limit.

The problem stems from a combination of factors.

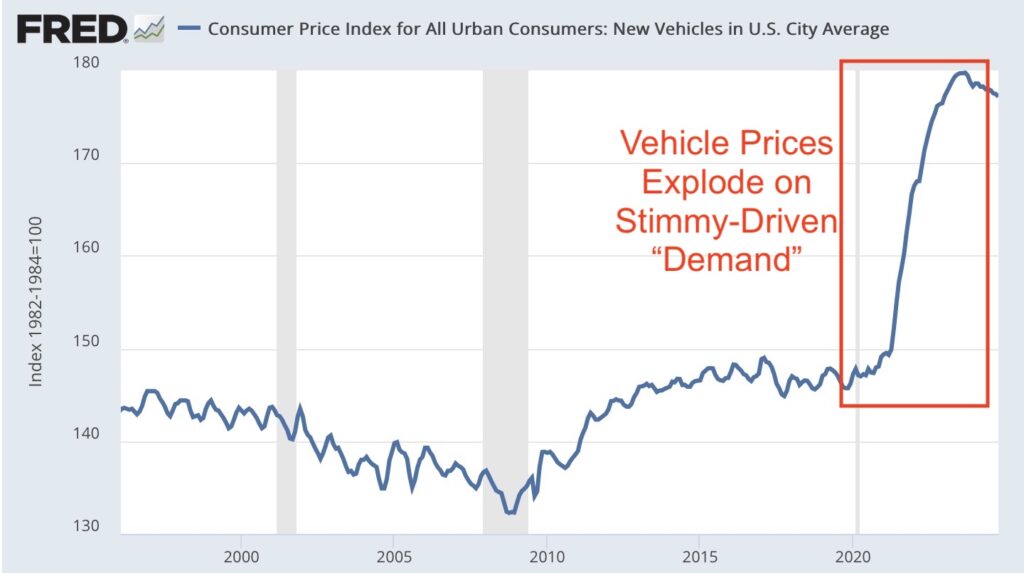

Back during the pandemic stimulus spree, the extra free money (not to mention the near zero financing cost) at the time made trading in the old car seem like a good idea.

The stampede to the local car dealer (along with the supply fiasco) drove new car prices through the roof.

After some 20-plus years of relative price stability in the new car market, prices exploded by over 20% in a span of three years thanks to all the “free” money.

Today, thanks to the sharply higher prices, auto loan balances rose by $18 billion in the last quarter alone, and now stand at $1.64 trillion — the highest category of non-housing debt.

These unaffordable prices are what’s behind the longer and longer financing terms.

Further according to Experian 33% of monthly car payments stand between $500-$700 per month. And, hold on to your hats, over 16% are over $1,000.

This would be fine if everyone could afford it. But 90-plus day delinquency rates on auto loans just upticked again to 4.6%. (Which might not seem bad compared to credit card delinquencies which have reached 11.1%!)

There’s an idea floating around that the economy is doing just fine.

But when you look past the headlines (and you don’t have to look far) you can see the strains building.