Washouts happen.

But ultimately they can be for the good.

Take Cisco Systems.

Back during the 90s tech boom, Cisco exploded becoming priced so far ahead of its earnings, that after it got its bubble comeuppance it never regained its previous highs. Still, the company bounced back, grew steadily and in early 2011 began paying a dividend. It went from being a superstar growth stock to a reliable dividend payer.

Cisco Systems (CSCO)

And while the company still hasn’t rebounded all the way to its all-time high, it has experienced a solid bullish trend from its lows.

Cisco is now a good stock to own.

Today, another of the pandemic darlings may be getting ready to rise from the ashes.

Is Zoom Ready to Boom Again?

Zoom Communications (ZM) — formerly Zoom Video Communications (more on that in a second) — could be repositioning itself to a similar end.

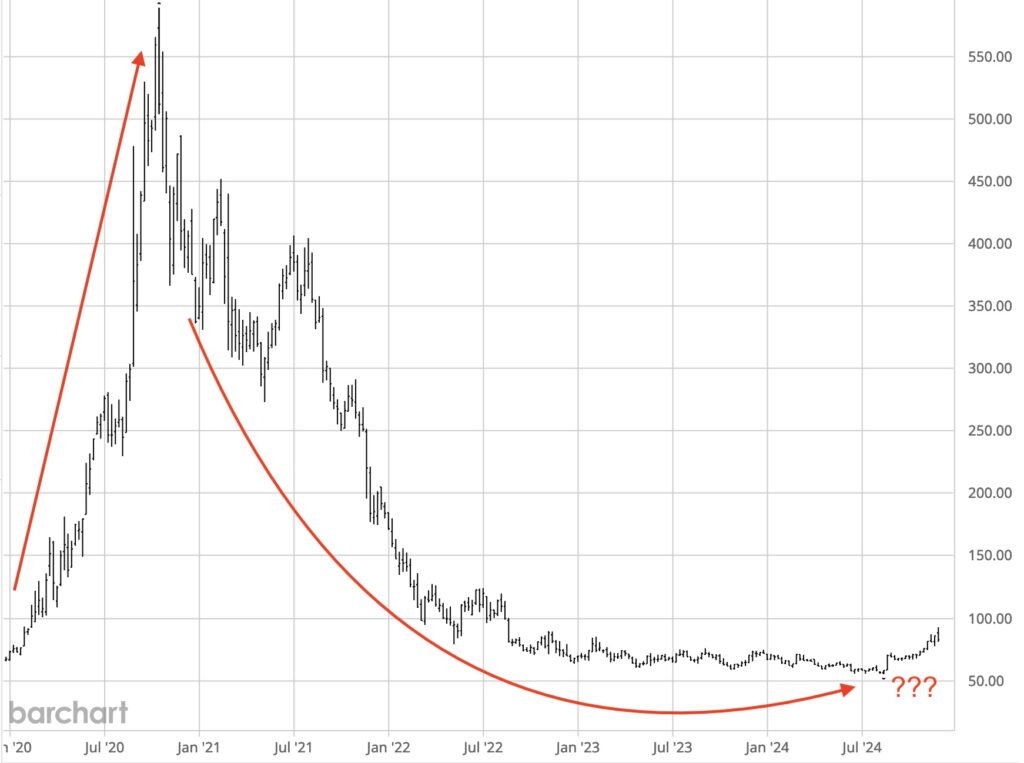

During its pandemic heyday, it was adopted as a major growth stock — a company with massive growth potential. It traded from an IPO value of around $63 to a staggering $550-plus in a matter of months.

A little too far out over its skis, the company crashed back to reality.

These days, however, the company has been performing well financially. Its most recent earnings report saw the company beat estimates on both earnings per share ($1.38 vs. $1.31 estimated) and revenue ($1.18 billion vs. $1.16 billion).

Its bottom line numbers also showed some significant improvement as well: $207.1 million up from $141.2 million in the same quarter a year earlier.

Surprisingly, the stock sold off on the news.

But the company recently announced a major shift in its business direction. It dropped the word “Video” from its company name to signal its expansion into the field of AI.

In reaction, the company is introducing a number of artificial intelligence (AI) features. It recently unveiled its AI-first Work Platform designed to help enhance interaction and productivity through AI tools. This includes its Zoom AI Companion 2.0, an AI assistant that can perform tasks such as summarizing conversations, identifying action items, and helping compose messages.

And the company has plans to introduce more AI-driven features, designed to target specific industries.

Leveraging AI functionality in their software could be a critical move in an age of exponentially growing digital data.

Zoom Communications (ZM)

While it may never see its lofty all-time highs again, Zoom could be rebuilding for a Cisco-style comeback.

And it may now be a stock worth watching…